An average of 19 slides, 3 minutes 44 seconds, and no margin for error- That’s all you have to convince potential investors that your startup is worthy of their investment! Going even a little off-mark on the length, data, or presentation means you will likely return empty-handed.

With such steep odds, a startup pitch deck presentation must be designed and presented with absolute perfection, or investors will quickly tune off. So, we’ll help you by listing out some points to help you optimize every aspect of your startup pitch deck. Let’s begin!

The Role Of A Startup Pitch Deck,

A startup pitch deck is a brief presentation that new entrepreneurs put together to give a quick yet comprehensive overview of their business to potential investors. It is aimed at raising funding to back the startup’s key activities and growth.

It is the first and most appropriate communication tool used by entrepreneurs to reach out to potential investors for their startups. This is because a startup pitch deck offers a quick startup overview in an easily understandable and visually appealing manner. It is usually presented by professionals from the startup and sometimes sent as emails for reference.

In simple terms, a startup pitch deck is a sales pitch for a startup that is presented to the investors to get their funding by promising and justifying the returns they will get from it. Here are the areas it covers-

- Your startup and its mission

- The market it operates in

- Your offerings and their unique selling propositions

- Your current traction

- Your startup’s future goals and vision

- How you plan to achieve the goals and by when

- Why investors should invest in your startup

Now that the basics are clear, it’s time to get to the checklist to help you make a successful startup pitch deck.

The 5-point Checklist For Crafting Your Startup Pitch Deck

Several businesses present pitch decks, but very few are compelling enough to get the required investments. Let’s check out some best practices to help you craft an unbeatable pitch deck that stands apart and convinces investors in minutes-

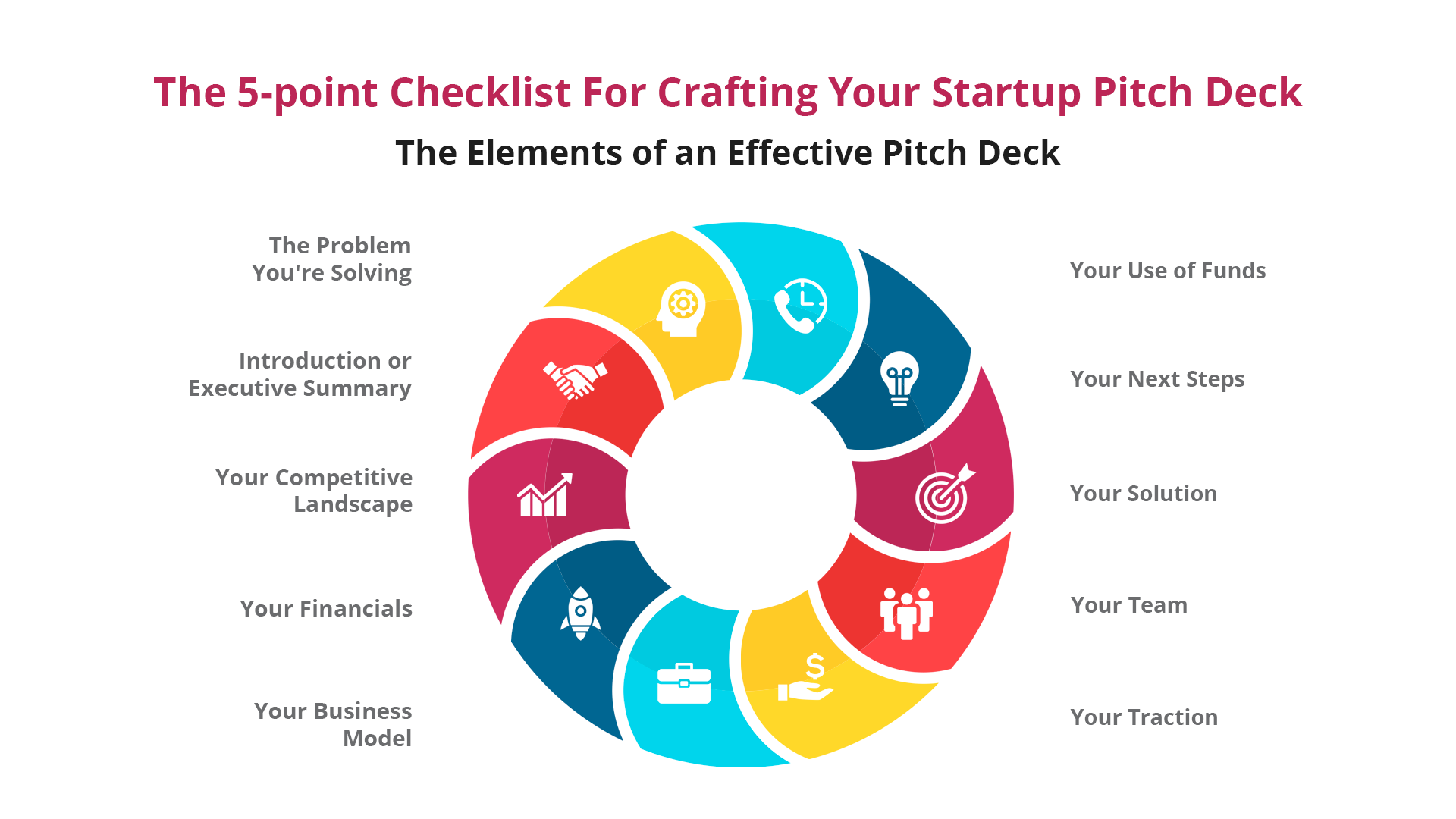

1. The Elements of an Effective Pitch Deck

The pitch deck slideshow must give potential investors a systematic overview of your business that convinces them about its profitability and growth potential. Accordingly, you should add the following elements to your pitch deck in chronological order-

- Introduction or Executive Summary: This includes a brief overview of your company and your business model that familiarises the investors with your business and gives context to your presentation.

- The Problem You’re Solving: Clearly state the problem you’re solving and why it requires a solution, with data to back your claims.

- Your Solution: Introduce your solution to the problem and briefly explain how it works. Use data to prove your solution’s effectiveness and explain what sets your product or service better than existing solutions. You may present a sample or prototype of your solution at this point or before starting.

- Your Business Model: Explain your plans to make money with your business. This is a crucial slide that must include all relevant information and statistics.

- Your Team: Introduce your founding team and other important team members by mentioning their experience and past achievements. Investors always prefer to work with good people in the team, so make sure you make a good impression!

- Your Traction: Show your progress to date with metrics such as user growth, revenue, and other KPIs. Include all past business data, case studies, and testimonials to explain your past growth while proving your potential.

- Your Market: Research and explain the characteristics of the market you are targeting, including its size, demographics, needs, problems, etc. On this basis, explain why there’s an opportunity for your business to grow in it. Emphasize the researched data to establish your claims.

- Your Competitive Landscape: Introduce the main players in your space briefly and cover what makes your offering unique (Unique Selling Points) and how you plan to beat the competition

- Your Financials: This slide includes your existing funding, profits/losses, other financial data, and projections. Investors often like to spend a lot of time on this aspect as it indicates your profitability, so don’t hesitate to add convincing data and spend some time on this slide.

- Your Use of Funds: Explain how you plan to use the funds you request in detail. Investors, like anyone else, would like to know where their money is going when they invest!

- Your Next Steps: Next comes a quick overview of your future goals and plans to achieve them. Include any milestones you’ve recently hit and show how you will go from there to your goals.

Next, you must request funding directly. You may use a supportive slide that summarizes exactly what the investors will get by investing in your business.

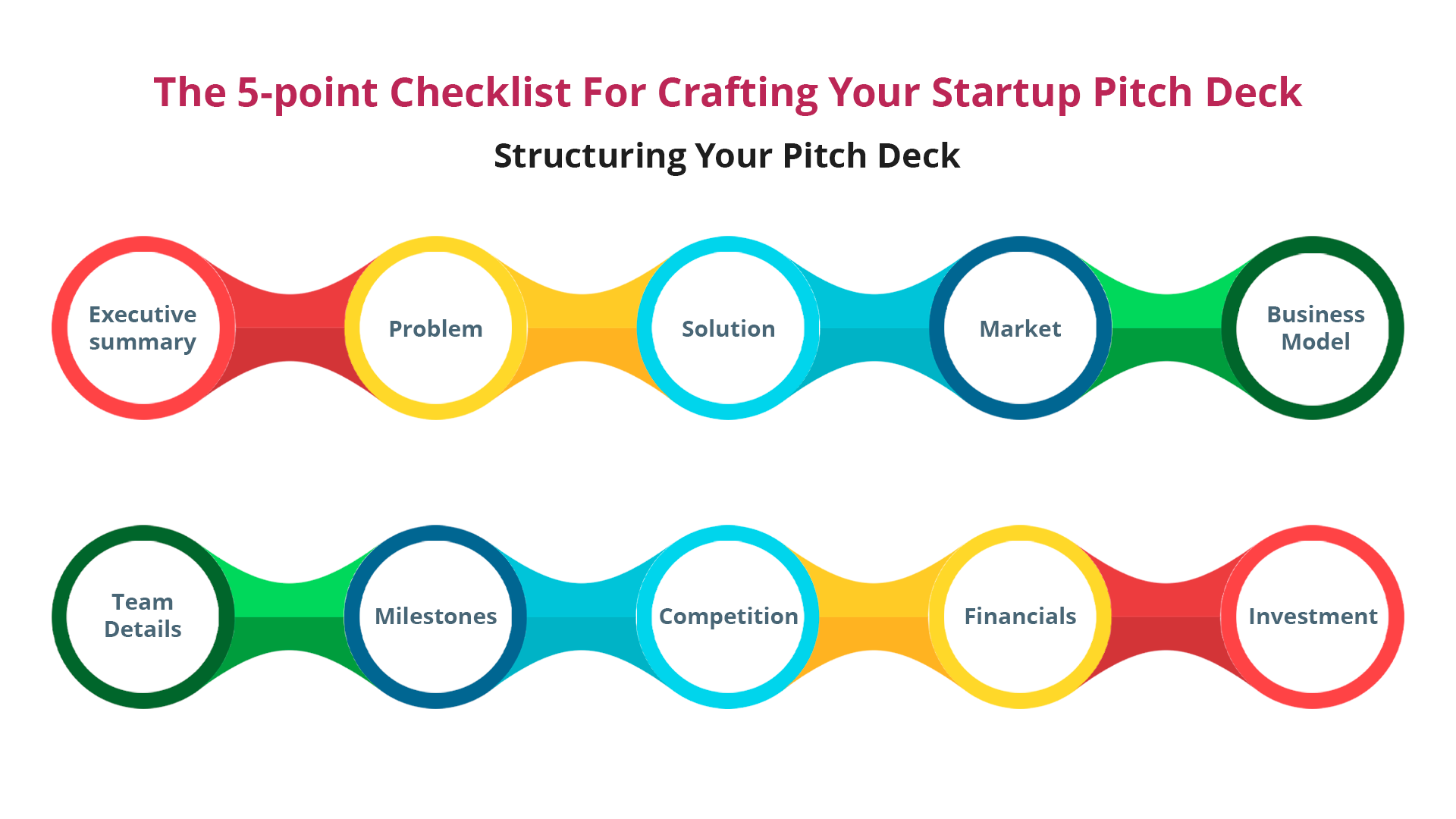

2. Structuring Your Pitch Deck

An effective pitch deck is around 19 slides in length and covers all the discussed elements in appropriate slides. Here is how you can structure your startup pitch deck-

- Executive summary

- Problem

- Solution

- Market

- Business Model

- Team Details

- Milestones

- Competition

- Financials

- Investment

While all elements must be given attention, the investment slide is the most crucial as it’s the make-it or break-it point. Here, you must make a convincing investment request while justifying why you need the particular investment. You need to emphasize the benefits your potential investor will likely get by explaining the equity arrangements, valuation, and expected ROI.

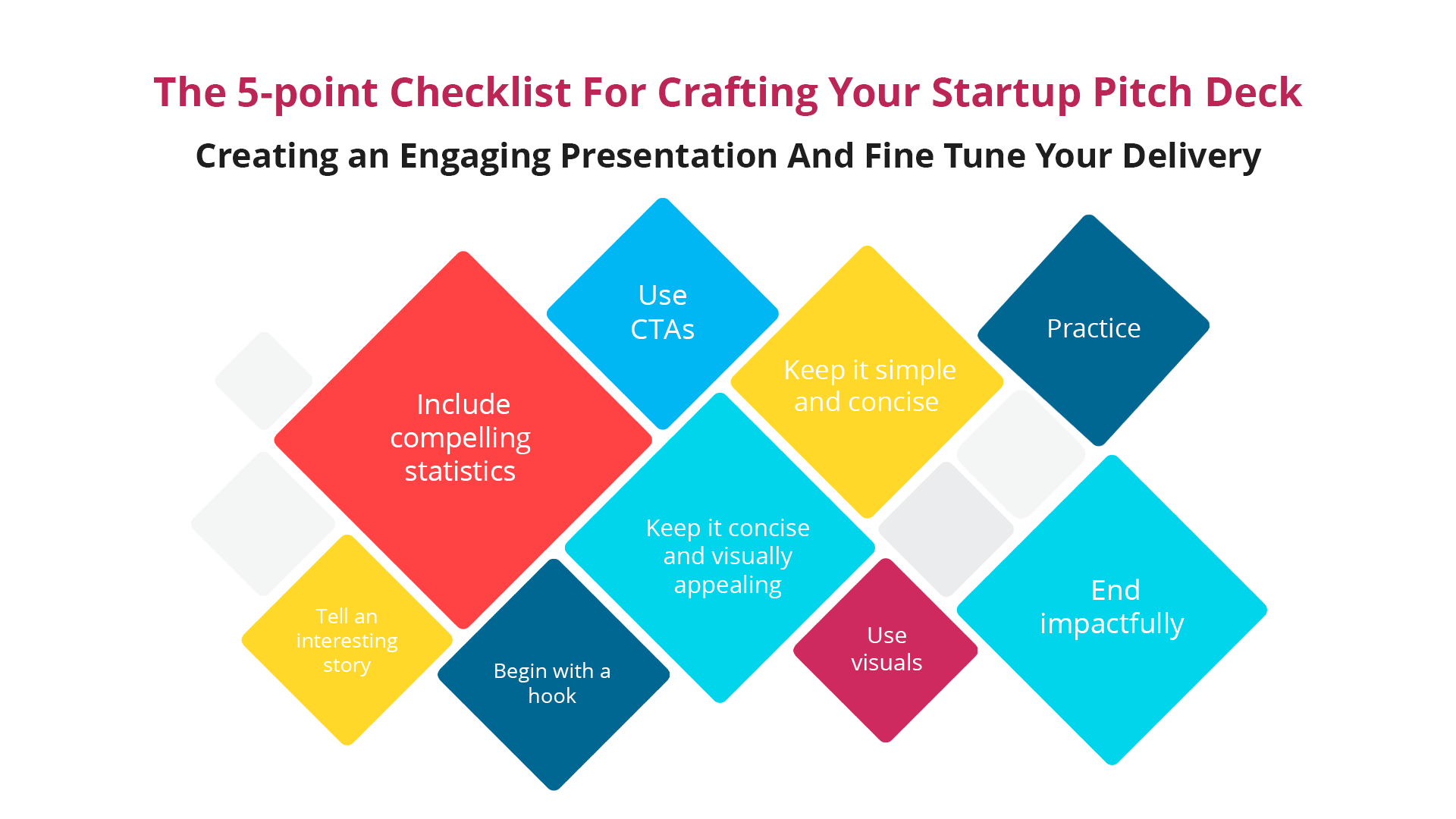

3. Creating an Engaging Presentation And Fine Tune Your Delivery

It’s time to check out some expert tips to create and deliver a pitch deck that engages and impresses your audience to ensure the maximum impact. Here’s how you can create and present an engaging pitch deck that hits all the right markers:

- Begin with a hook: Start with a strong hook statement that captures your audience’s attention. This may include key statistics, interesting facts, a relatable problem statement, or anything else that makes heads turn!

- Tell an interesting story: Tell a compelling story revolving around the problem you’re solving and how your product or service is the best solution for it.

- Use visuals: Use images and infographics to make the slides more attractive and easy to understand wherever applicable.

- Keep it concise and visually appealing: Always use high-quality visuals and graphics and avoid cramming in too much text or information, or your audience will likely tune off.

- Practice: You should know the ins and outs of your pitch deck and your prospective investors before the presentation to perfect your delivery. Continuously practicing and improving will boost your confidence and improve your presentation while saving you a lot of stress!

- Include compelling statistics: Use data and statistics to back up your claims wherever possible. This will boost your credibility and make your claims impactful.

- Keep it simple and concise: Stick to the basics and exclude anything that isn’t essential. Also, avoid overusing technical jargon and use graphics to summarize the information wherever possible.

- Use CTAs: Use strong calls to action at every appropriate point to keep the audience engaged while creating a build-up to the final CTA.

- End impactfully: Conclude the slide show by summing up your key points, thanking your audience, and delivering a convincing call to action that reminds investors what’s in it for them.

Moreover, you should share relevant documents or samples in advance, if possible. This will ensure the investors are better equipped to understand your presentation. If your topic is complex, you should also ask if there are any questions at the end. Addressing the queries confidently with facts will enhance your credibility and persuasiveness.

4. Responding to Investor Questions

Once you’ve put together an amazing pitch deck and practiced the delivery, you’ll feel ready to start seeking out investors. But you’re still missing something!

Before you start meeting with potential investors, you must make sure that you’re prepared to answer their questions. After all, questions are guaranteed as investors will naturally want to understand your business and its profitability in detail before investing.

So, here’s a checklist of key questions you should anticipate and answer beforehand based on proper business understanding and market research-

- How will you generate revenue?

- What problem is your business solving?

- Who is your target market?

- What amount do you need to raise?

- How will you use the investment you are asking for?

- How will you scale up the business?

- What are the risks and challenges your business may face?

- What are your long-term business goals?

- Who are your team members?

- What are your competitive advantages?

- How have you been validated so far by your customers?

- What is your SWOT (Strength, Weakness, Opportunity, Threat) analysis?

- Do you have a prototype?

5. Following Up After the Pitch

Investors showing interest after your pitch is indeed an achievement, but don’t party yet! There’s still some work to be done, and it’s called following up.

Following up through regular messages or meetings is vital to strengthen the relationship with the investor and cement your positive image. The follow-up will also allow both sides to address any concerns or doubts. And the decision to finalize the investment will be taken in the subsequent follow-ups. So, a good follow-up is essential to seal the deal, or you may miss out on the investment!

Here are some essential steps required in the follow-up after your presenting your startup pitch deck:

- Send a personalized thank-you note.

- Send a copy of the pitch deck file and other requested documents.

- Send a summary of all the key points and statistics.

- Solicit and address any questions or concerns.

- Include additional information you couldn’t cover in the pitch deck.

- Set up subsequent meetings or calls to finalize the investment.

Common mistakes to avoid

Here are some common traps that startup founders fall into while making or presenting their startup pitch deck:

- Making the pitch deck too long, especially over 25 slides or over 4 minutes in duration.

- Underestimating or dismissing your competitors.

- Failing to anticipate or prepare for questions or harsh feedback.

- Providing unrealistically high or low projections.

- Getting focused only on facts and details and not telling a relatable story.

- Failing to do the necessary background research or analysis.

- Presenting a low-quality or unprofessional pitch deck.

- Not introducing your team impactfully.

- Not explaining what the investors will get in return convincingly.

- Overloading slides with excessive jargon and details that you can address in emails, documents, or follow-ups.

Examples

As we discussed, an effective startup pitch deck is a mix of good design, precise and updated information, concise yet comprehensive presentation, viable growth metrics, and a team and vision that’s worth investing in. Here are some examples to give you an idea of the most successful startup pitch decks-

Buffer

Uber

Quora

The Bottom Line

Go ahead and use our checklist to make an attractive and persuasive startup pitch deck that convinces investors and brings unprecedented investments.

If you need help creating a winning startup pitch deck, the experienced professionals at Infobrandz are here to create the most compelling pitch decks for you at competitive prices. So, just outsource all the hard work to us and focus on preparing your team for a captivating presentation!

0 Comments