D’you have a million-dollar business idea but no investment to back it? You’re not alone! Many startup owners approach several investors with elaborate slide shows to prove their business’s potential but fail to secure investment.

In fact, just 1% of investor deck presentations successfully raise funds, as per Inc. magazine’s report. And this brings up two questions.

What goes wrong with the other 99%, and how can your investor deck get into that elite 1%?

We did some digging and found the answers to help you avoid common mistakes and impress prospective investors with an unbeatable investor deck. Let’s dive in!

Why go for an Investor deck?

The low success rate of investor pitch decks does paint a gloomy picture, but it is still your best tool to convince investors and get your business rolling! The trick is to avoid the common traps and optimize your investment deck to unbeatable standards.

Before we get to the mistakes and how you can avoid them, it’s essential to understand what a good investor pitch deck looks like. So, here are some key characteristics of an effective investor pitch deck-

- A minimalistic and straightforward approach

- Use of a narrative with real-life examples

- Claims and requests are backed by verified facts and statistics

- A standalone pitch deck that has sufficient information for future reference

- Updated pitch deck that tailored it to the investors in the audience

- Professional tone and high-quality content with no fluff

- An average of 19 slides with an ideal length of 3 minutes 44 seconds

- Proper structuring that covers the key aspects of the pitch deck chronologically.

Here is a successful investor pitch deck example from Dropbox-

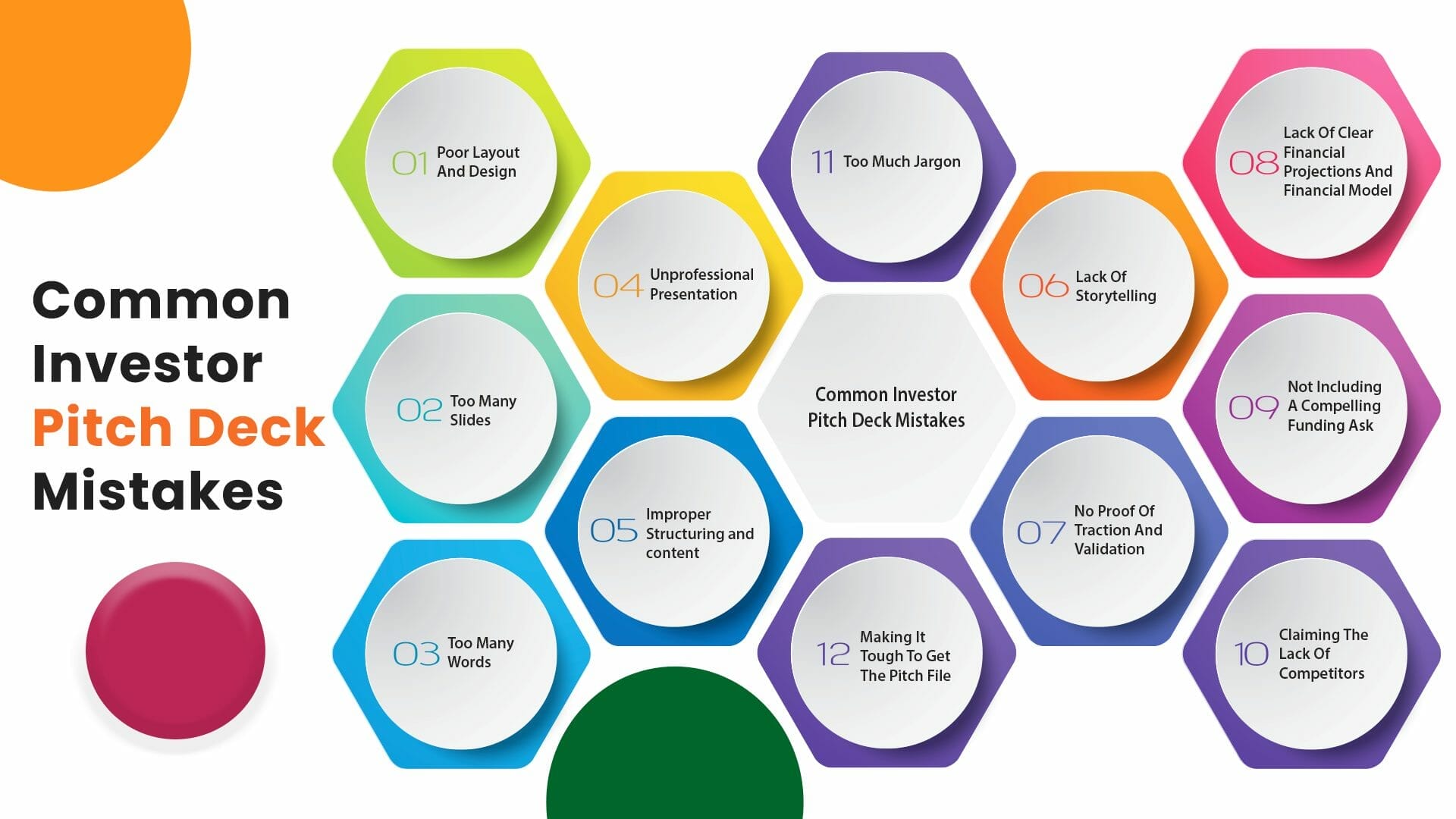

Common Investor Pitch Deck Mistakes

Now that we have clarified what a good pitch deck is, it’s time to find out where things go wrong. Here are the 14 most common investor pitch deck mistakes-

1. Poor Layout And Design

Another common error is choosing the worst design and layout for the presentation, leading to a bad impression. And a poor first impression is the last thing you want in an investor deck for investment!

So, the layout and design must be visually appealing, easily understandable, and relevant to the topic. Here are some things you should consider to build a good design and layout-

- Margins

- Font Size

- Color Palette

- Images

- Consistency of the elements

- Template

Moreover, you should send a PDF rather than an editable PowerPoint file when sharing the pitch deck to ensure the layout does not change.

2. Too Many Slides

You may be tempted to put as much information as possible in your pitch deck, but there’s a tradeoff between your investor’s attention and the number of slides you add.

You must add enough slides to cover all essential aspects of your business with their key statistics. But adding too many slides will get boring, and investors will tune off, meaning that even your most convincing points will be lost amongst the long content!

In general, the correct number comes to around 20 slides, in which you must summarize your business model and market opportunities to prove the potential of your startup.

3. Too Many Words

Adding too many words is as big a problem as too many slides, and the reason is the same too. Wordy slides and small or complex fonts are tough to follow and may cause the audience to lose interest immediately.

So, you should use large and common fonts with bullet points and visuals to reduce the number of words needed. You should also avoid cramming in too much information. The key is to find the right balance between the amount of information you put in the slide and the number of slides.

4. Unprofessional Presentation

Your investor deck presentation needs to be well-structured and professional to ensure prospective investors can easily follow and understand it. You must have a professional-looking design, smooth transitions, and easily understandable infographics. All elements should be personalized and easily legible.

The typical presentation mistakes to avoid are inconsistent font sizes and types, irrelevant and informal content, too much or too little content per slide, flashy transitions, and ununiform element spacing.

5. Improper Structuring and content

A logical and ordered structure is a must for any presentation, but it is especially crucial for a formal investor deck. Your investor pitch deck should cover these key aspects in about 20 slides within 4 minutes-

- Company Overview

- Mission/Vision of the Company

- The Team

- The Problem

- The Solution

- The Market Opportunity

- The Product

- The Customers

- The Technology

- The Competition

- Traction

- Business Model

- The Marketing Plan

- Financials

- The Ask

Also, the content you add to the structure must be relevant, concise, interesting, and easily understandable. For this purpose, you can add explainer videos, images, and infographics wherever required. However, the format and content may need adjustment based on the offering, market, niche, and investors’ expectations.

6. Lack Of Storytelling

A compelling investor deck uses storytelling to create a lasting impression on investors. You can highlight your journey behind the creation of the startup, the unique value it offers to customers, the startup’s position within the industry, and how you plan to grow it to achieve your missions. A storytelling approach makes the presentation memorable and engaging while displaying your confidence and knowledge.

7. No Proof Of Traction And Validation

Your business may be great on paper, but real-life results and numbers are what give investors confidence. Many startup pitch decks miss out on this aspect and focus only on the solution without providing evidence to prove its practicality.

If your startup is already generating revenue, you must show your figures and growth to prove your future potential. If you have a pre-revenue startup, you must convincingly explain your estimated figures and traction based on your plan, prototype, and customer case studies. Some figures that may justify your traction are-

- Results of early customers or pilot programs

- Strategic Partnership

- Revenues or other key financial metrics (if already functional)

- Testimonials

- Progress on product development

- Press and PR

8. Lack Of Clear Financial Projections And Financial Model

Founders often fail to prepare or present their financial models and projections clearly. But a well-thought-out financial plan and reasonable projections are what can make all the difference by proving that your business is financially practical and sustainable.

While presenting them, you must back up your numbers with solid research and logic to show how you will earn profits, grow your earnings, and sustain your business.

9. Providing Unrealistic Projections Or Ambiguous Explanations Of Fund Use

Unrealistic company evaluations and profit predictions will put off investors immediately. You must do your homework and provide realistic and practical projections. You must consider all market factors and analyze your business model simultaneously to offer and properly justify your forecasts.

This will help you make convincing calls to action by using this data to show how you will use the funds you request from investors and how they will build profits and ROI.

10. Not Including A Compelling Funding Ask

A major mistake that seals the fate of your startup pitch deck is not including a clear and convincing funding ask in your deck. Surprisingly, many businesses overlook this obvious aspect in their effort to prove their business’s potential. As a result, they end up with an unclear or unreasonable demand.

Here are the factors you must consider while planning the final call to action and the amount to ask for-

- Your startup’s requirements

- Percentage of Equity

- Type of Instrument

- Minimum Ticket Value

- Where will the money be Spent

- Expected Runway

When you request funding, remember to revisit the key points that prove your potential and remind the investor what they can earn by investing in your business.

11. Claiming The Lack Of Competitors

Claiming that the market does not have competition may sound like a convincing argument, but it actually makes investors doubt the potential or even existence of the market. This is because a lack of competitors indicates that no one has shown interest in the market as it is not profitable. A healthy competition signals that the market is robust.

So, you should not undermine the existing competition and instead provide an in-depth competitive analysis to show that you know how the market works! If there really isn’t any competition, you can briefly explain why you think competitors have missed the chance.

12. Too Much Jargon

The target investors might not know much about your industry or niche, let alone your specific product or service. So, your investment pitch decks must be simplistic and free of unnecessary jargon or technical terms. You should also define any complex terms briefly if you can not avoid using them.

However, there’s an exception. Adding some jargon or acronyms may help exhibit your expertise and attract investment if the target investors already have knowledge in the area.

13. Not Doing Your Homework

The importance of homework before the investor deck cannot be overstated. A great business idea and high potential are not sufficient to get funds! You must focus on approaching the right investors with excellent investment pitch decks. Moreover, you must anticipate the possible questions and feedback and prepare to respond to them correctly.

This is crucial because even the most straightforward questions often become tough under the stress of impressing the investors unless the presenters have already practiced their answers. The most common questions are about market opportunity, risks, competition, financials, key metrics, the use of the investor’s money, evaluation, and intellectual property.

14. Making It Tough To Get The Pitch File

Remember to directly share the investor deck file as a PDF in advance instead of using any cloud service or editable format. Moreover, it is suggested you don’t insist on a non-disclosure agreement straightaway. But this may depend on your specific needs and concerns.

Summing up

Avoiding these 14 common mistakes will boost the effectiveness of your investor deck and greatly raise the likelihood of obtaining financing for your startup. Just remember to make exceptional pitch decks by leveraging the expertise and experience of a reputed pitch deck-building service like Infobrandz. And make sure to do your homework before presenting the investor deck to get the investment your business deserves!

0 Comments